Customer Data Analytics and Insights Key to Post-Pandemic CPG Success

The COVID-19 pandemic and recent rise in social unrest has created significant shifts across the consumer packaged goods (CPG) industry and its value chain. For a year best described as “unprecedented,” these changes will have a lasting impact on brands across retail and consumer goods. Examples include:

- Major restructuring of brands through assortment rationalization. Industry leaders such as Mondelez, Unilever and Coca-Cola culled “zombie brands” to maximize economies of scale in production and distribution.

- Reallocation of ad spend as companies reassess best channels for engagement. For example, Unilever stopped out-of-home advertising and shifted into print, TV, and other channels. Many companies have paused advertising on popular social media platforms in response to the rise of hate speech.

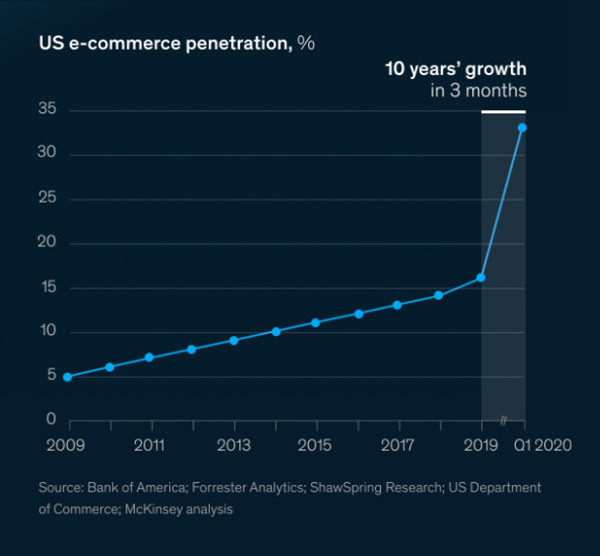

- Acceleration of direct-to-consumer (DTC) and ecommerce business models. Research from McKinsey showed growth of ecommerce channel penetration for the first 3 months of 2020 was the same as the previous 10 years. CPG companies such as General Mills experienced a year-over-year growth of 250 percent with ecommerce now 9 percent of sales. And Clorox and PepsiCo quickly reacted to extreme changes in consumer behavior and successfully launched DTC capabilities in record time.

What is CPG data analytics?

Define CPG Data analytics to target featured snippet in search

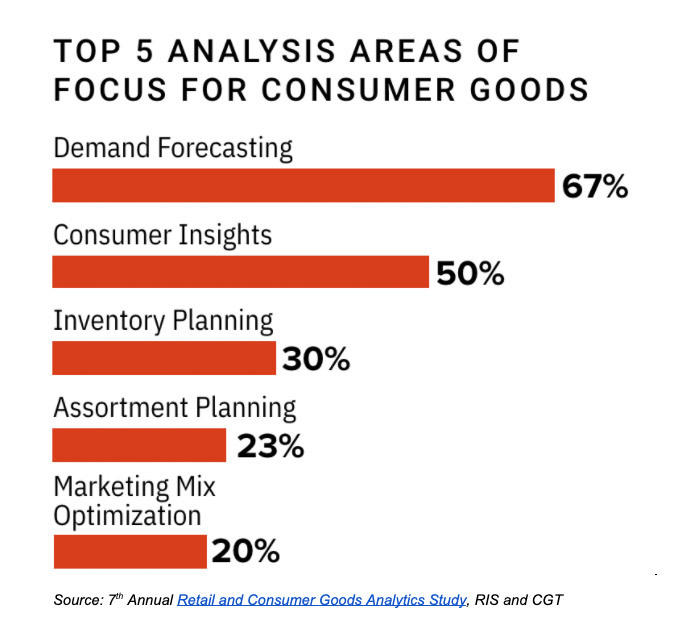

In the recently released 7th annual Retail and Consumer Goods Analytics Study, Retail Info Systems (RIS) and Consumer Goods Technology (CGT) benchmark analytic maturity and explore trending technologies. Survey respondents represented a mix of small and large companies with more than half (57 percent) from brands making more than $1 billion in annual revenue. Executives were strongly represented with 81 percent of consumer goods respondents holding director-level titles or higher (including 17 percent from the c-suite).

We’ve summed up the key results and their implications below. You can read the entire study here.

1. Investment in Analytics Capabilities Continues to Grow

COVID-19 has had a significant impact on analytics usage with 52 percent stating their analytic resources shifted or changed, so they could “more quickly react” or “analyze faster.” Clearly the need to make quick, data-driven decisions will continue to be key for the success of retail and CPG brands.

Nearly 7 percent of those surveyed expect their analytic spend to approach 25 percent of their total IT budget by 2023. And the investment in human capital is also considerable with 30 percent either hiring internally or outsourcing to partners.

2. Top Focus Areas All Require Unified Data

Source: 7th Annual Retail and Consumer Goods Analytics Study, RIS and CGT

The turbulence of 2020 has highlighted costly weaknesses in the consumer goods industry. As consumers stockpiled their pantries at the start of shelter-in-place orders, store shelves were quickly emptied and remained so for weeks at a time. With this in mind, it’s not surprising that demand forecasting is the number one area of focus for leaders in the consumer goods industry.

Consumer insights was the second highest area of focus for consumer goods manufacturers, with 50 percent stating it was a key area of focus. Similarly to challenges seen with demand forecasting, inventory planning came in third with 30 percent.

The common element for all three of these areas is the need for integrated and unified data—whether it’s operational information from across the value chain to drive insights in demand forecasting and inventory planning or consumer data that can drive insights for brand building. CPG marketers often use a customer data platform (CDP) to activate these insights, but the integrated data in a CDP can also be used to enable product innovation and development, demand sensing, and hyperlocal demand forecasting.

3. Obtaining Insights Is Still a Significant Challenge

Source: 7th Annual Retail and Consumer Goods Analytics Study, RIS and CGT

A whopping 70 percent of CPG companies said the top challenge their organization faces is an inability to integrate data from multiple sources. This is certainly a barrier to maximizing value, since to make better business decisions requires insights, and insights require data that often needs to be sourced from multiple systems and even from external partners. Unfortunately, 52 percent of CPGs say their retail partners are not sharing online customer behavior data.

Compounding the data challenge is the lack of capacity and capabilities. Forty-seven percent of those surveyed said a center of excellence (CoE) should be managing analytic activities, yet only 10 percent currently have this capability. CDP solutions can help close this gap by providing data integration and insights that remove much of the technical burdens.

Source: 7th Annual Retail and Consumer Goods Analytics Study, RIS and CGT

Strategies for CPG Success Beyond the Pandemic

What are the next steps for CPG companies that want to leverage data analytics and data insights? Based on this survey, here are the top three recommendations.

- Explore implementing a DTC model to not only drive an additional revenue stream but to also collect first-party data that currently is often inaccessible and likely won’t be shared in the near term by retail channel partners.

- With consumer insights being a key area of focus and data integration being a fundamental challenge, consider deploying a customer data platform (CDP) to integrate and unify the disparate and siloed consumer data that exists across technical systems and organizational teams.

- In your consideration of a CDP, look at total cost of ownership to ensure maximum return on investment given the competing initiatives for IT budget. Additionally, it is important to think about how to best future-proof your CDP investment by selecting a partner with a flexible and adaptable platform. As we have seen over the past few months, speed and agility are key to success. And with the marketplace and technical landscapes changing so rapidly, you want a partner that is equally adaptable.

Treasure Data CDP empowers companies by delivering rich customer insights that drive outstanding customer experiences and personalization. To learn more about how Treasure Data is helping global CPG brands, visit Treasure Data.